Executive Summary

In Q3 2024, X-FAB reported revenues of USD 206.4 million, marking a 12% decline year-on-year but a slight increase of 1% quarter-on-quarter. The company’s bookings amounted to USD 217.1 million, resulting in a book-to-bill ratio of 1.05, reflecting a robust demand despite market challenges. EBITDA was reported at USD 50.3 million, down 23% YoY but up 5% QoQ, with an EBITDA margin of 24.4%.

Looking ahead, X-FAB has adjusted its full-year revenue guidance to USD 822-832 million, citing current market conditions and an operational incident impacting production. The company’s long-term outlook remains optimistic, driven by strong end-market demand, particularly in automotive and medical sectors.

Strengths:

- Strong Automotive Demand: Robust growth in the automotive sector supports overall revenue stability.

- Positive Cash Flow: Q3 generated USD 78.8 million in net cash from operating activities, demonstrating strong operational efficiency.

Weaknesses:

- Declining Industrial and Medical Revenues: Significant YoY declines in these sectors reflect potential market saturation and reduced demand.

- Margin Compression: Increased costs led to a decreased gross profit margin, impacting overall profitability.

Highlights

Revenue: USD 206.4 million

- Within guidance of USD 205-215 million

- Down 12% year-on-year (YoY) and up 1% quarter-on-quarter (QoQ)

Bookings: USD 217.1 million

EBITDA: USD 50.3 million

- Down 23% YoY, up 5% QoQ

- EBITDA margin: 24.4% (23.5% excluding IFRS 15 impact)

EBIT: USD 25.0 million

Outlook

- Q4 2024 Revenue Guidance: USD 195-205 million

- EBITDA Margin Guidance: 22-25%

- Full-Year Revenue Guidance Adjustment: From USD 860-880 million to USD 822-832 million

- Full-Year EBITDA Margin Guidance: Adjusted to 23.4-24.0%

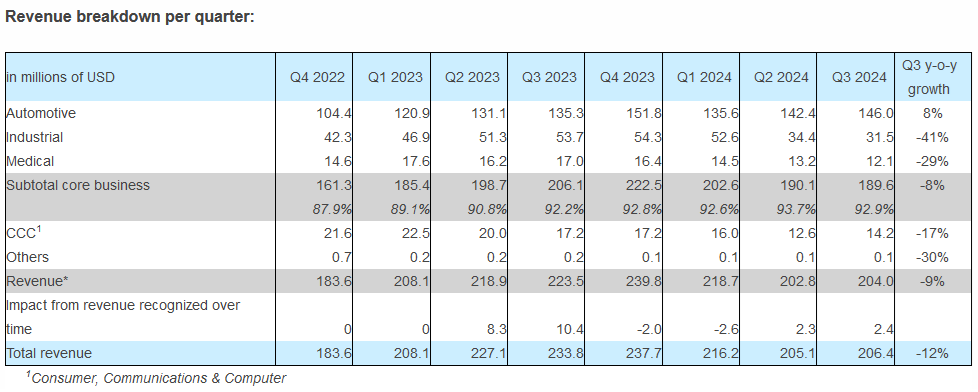

Revenue Breakdown

Core Markets

- Automotive: Grew 8% YoY

- Industrial: Decreased 41% YoY

- Medical: Decreased 29% YoY

Prototyping Revenues

- Q3 2024: USD 23.6 million (down 14% YoY, up 12% QoQ)

Operations Update

- Continued capacity expansion focusing on 180nm and 110nm CMOS technologies.

- Operational incident in Malaysian factory caused a three-day production slowdown, now resolved.

- Total capital expenditures in Q3: USD 149.8 million.

Financial Update

- Cash and Cash Equivalents: USD 315.9 million

- EBITDA Margin: 24.4% (constant exchange rate impact negligible)

Read the full report here: https://www.businesswire.com/news/home/20241024722290/en/X-FAB-Third-Quarter-2024-Results

![]()