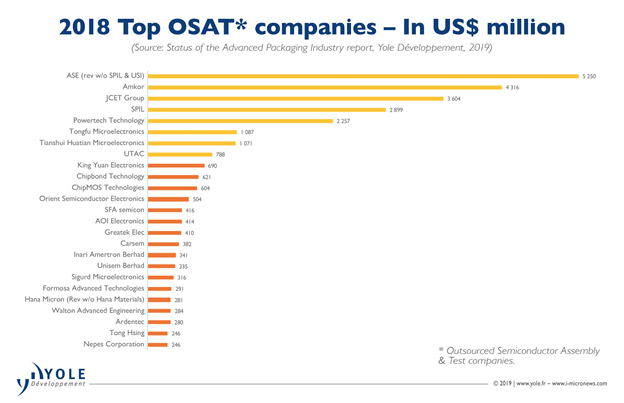

The leading giant of the OSATs, ASE Technology Holding Co., Ltd. (formerly ASE Inc.) and subsidiaries, has just got even bigger after the official acquisition of SPIL on April 30 2018. In 2018e, ASE Technology Holding Co., Ltd and subsidiaries made a new record-high revenue of US $12,308 billion, which is almost three times of Amkor’s second-in-place revenue, US$4,316 billion. Even if SPIL and USI revenues are separated from ASE Technology Holding Co., Ltd. and subsidiaries, the former ASE Inc. business revenue was US$5,250 million in 2018, which is still the highest amongst other OSATs leaders.

“On the other hand, if we only take into account the YoY growth of each company, the analysis will be very different”, explains Favier Shoo, Technology & Market Analyst at Yole Développement (Yole). “Within the Top 5 OSATs, ASE (without SPIL and USI), Amkor Technologies and JCET Group were all showing good growth between 2~3% YoY. SPIL grew strongly with a 5% YoY while PTI outperformed with an impressive growth of 15% YoY. This truly reflects the fierce rivalries amongst the OSAT leaders to strive for more business.”

Clearly, the 2018 top OSATs sky-high revenue was segmented from the rest of the pack. This gap in market share is mainly due to the legacy in business and consolidations by merger & acquisition that has taken place in recent years.

For the top 5 OSATs including ASE, Amkor, JCET Group, SPIL and PTI, Yole did not see any changes in the ranking of revenue from 2017 to 2018.

However, there were many changes in revenue ranking for the remaining players between 2017 and 2018 estimations. “This part of the annual ranking is more volatile than 2016e to 2017e,” comments Santosh Kumar, Principal Analyst & Director Packaging, Assembly & Substrates, Yole Korea. And he explains: “Tongfu Microelectronics, Chipbond Technology, SFA semicon, Inari Amertron Berhard, Sigurd Microelectronics and Hana Micron had achieved high YoY revenue growth and moved up the ladder. Meanwhile, Unisem Berhad, Walton Advanced Engineering, Tong Hsing and Nepes Corporation have dipped in position with negative YoY revenue growth. Ardentec has achieved a good 8% YoY but its rank has dropped by a level.”

Apart from strong revenue performances, leading OSATs are still continuing with heavy investment in CapEx and R&D. More than 70% of CapEx and R&D investments came from Top 8 OSATs in 2018. With such widening disparity, companies in the tail-end are at a higher risk of more losing more market shares. If there is no differentiated technology or IP for mergers & acquisition as an exit strategy, smaller players could be phased out eventually.

From 2017 to 2018, non-Top 8 OSATs have improved gross profits and net income. However, with increasing investments and revenues from TOP 8 OSATs, their margins and profitability are likely to decrease in the long run. It is noted that the highest relative CapEx came from Ardentec and some non-advanced packaging houses.

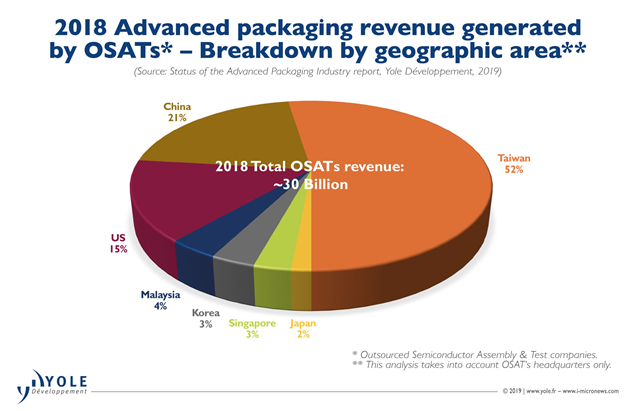

Geographically, Top 8 OSATs revenue in 2018 now includes 3 manufacturers HQ in China which is noticeably more, as compared to only 1, in 2014. Singapore and Japan are left with one OSAT in TOP 25. Out of Top 25 OSATs, Taiwan-based OSATs contributed more than half of the revenue in 2018 followed by China, US and Malaysia who displaced Korea from 4th position in 2017. 2018 is yet another year of active R&D spending by the Chinese, Taiwanese and Korean OSATs which is equally important for future growth and innovation.

With the boom in the microelectronic industry, new demands for performance, connectivity and mobility are on the rise. As a result, OEMs, Fabless, IDMs, foundries are increasingly reliant on OSAT companies to create new values in packaging performances and testing capabilities. The long-standing view of OSAT industry is positive. It is worth noting that leaders of the Top 25 OSATs are substantially improving their product portfolio by merger & acquisition and innovations. Some non-leading OSATs with spot-on strategy stand to gain from the overall growth as well. Unfortunately, there are lingering woes on profitability for the remaining OSATs who are relatively inactive and smaller in size.

The advanced packaging industry and all platforms are deeply analyzed in Yole’s annual report, Status of the Advanced Packaging Industry. The market research and strategy consulting company will release next week its 2019 edition. In addition to the 2018 OSATs ranking. Yole’s analysts disclose the status of the industry with drivers and dynamics, futures applications, disruptions and opportunities. More info.

The advanced packaging team investigates daily to identify emerging and disruptive semiconductor technologies and understand market evolution. Its exchanges with the leading advanced packaging companies allow Yole’s analysts to get an up-to-date vision of the industry status. Follow our analyses, presentations and conferences on i-Micronews.com and be part of our community: Subscribe.